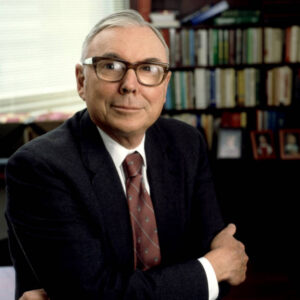

Charlie Munger passed died in a California hospital on Tuesday night at the age of 99, according to a mournful notice made by Berkshire Hathaway. It was commonly known that Munger, the billionaire benefactor and vice chairman of Berkshire Hathaway, was the closest confidant of Warren Buffett.

Buffett’s Tribute: Berkshire Hathaway’s Giant’s Contribution

Chief Executive Officer of Berkshire Hathaway, Warren Buffett, expressed profound grief over Munger’s passing and noted that the firm would not be where it is today without Munger’s “inspiration, wisdom, and participation.” With this loss, a dynamic duo that was instrumental in reshaping the investment spaces comes to an end.

Early Life and Remarkable Journey:Charlie Munger’s Century

Charlie Munger, who was born in 1924, would have celebrated his 100th birthday on New Year’s Day. Munger, a real estate specialist by training, was a partner at the prestigious Los Angeles law firm Munger, Tolles & Olson prior to forming a partnership with Buffett and Berkshire Hathaway in 1978.

Multidisciplinary Knowledge in Engineering, Meteorology, and Law

Munger was a Harvard Law School alumnus with a wide range of knowledge outside the legal field. Despite having a degree in meteorology, he surprised a lot of people by showing a strong interest in engineering, which ultimately motivated Berkshire Hathaway to invest in the Chinese automaker BYD. Munger continues to have a lasting impact on Berkshire Hathaway’s investing choices even after recent stake reductions in BYD.

An Everlasting Doctrine: Munger’s Investment Philosophy

Buffett introduced Munger to the world of investing, but it was Munger who stressed the value of purchasing a superior company at a reasonable price, a notion that became central to both investment philosophies. His well-known “invert” tip and emphasis on long-term compounding are still widely used in the financial industry.

Generosity Beyond Finance: Buffett’s Recent Donation and Philanthropy

Beyond the world of finance, Munger left behind charitable pursuits. A week prior to Munger’s demise, Warren Buffett contributed $866 million worth of Berkshire’s stock, marking yet another milestone in their mutual dedication to charitable giving.

You can also join our Facebook Community

You can also read about Rohit Bal

You can also check out our YouTube channel

[…] You can also read about Charlie Munger […]